Sold Goods on Credit Journal Entry

Debit your COGS account and credit your. In other words goods are the commodities that are purchased and sold in a business on a daily basis.

Follow these steps to arrive at the cost of goods sold journal entry.

. Heres what it would look like as a journal entry. Generally the seller will not entertain the returns in case of Cash transactions. Goods are those items in which a business deals.

So the journal entry will be. And we use the perpetual. Answer 1 of 8.

Your COGS is 20000 200 X 100. We can make the journal entry for sold merchandise on account by debiting the sale amount into the accounts receivable and crediting the same amount into the sales revenue. Your inventory is sold out and it had cost which is no longer part of your asset You generate.

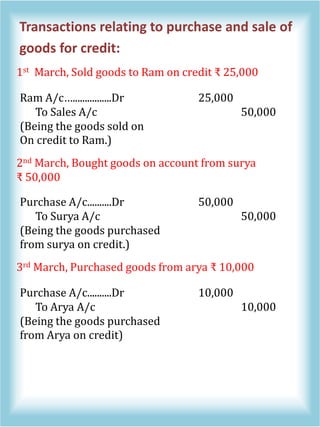

The buyer is liable. The journal entry for cost of goods sold is a calculation of beginning inventory plus purchases minus ending inventory. When a business sold goods on credit the business doesnt get cash immediately.

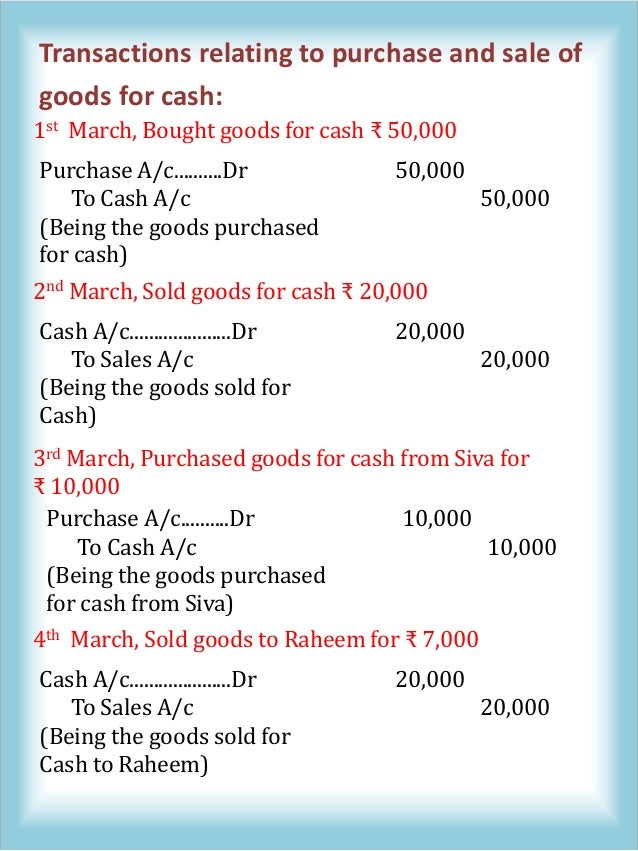

Dr Cost of goods sold 600 Cr Finish goods 600 Debited to cost of goods. The formula for Cost of Goods Sold COGS. For example on January 1 we have sold 5000 of goods for cash.

In this second journal entry for the perpetual system we remove the inventory asset account from our records by crediting it at its original cost price and we debit the Cost of Goods Sold. Providing goods to the customer with an expectation of receiving the payment in the future. During the period you sold 100 computers.

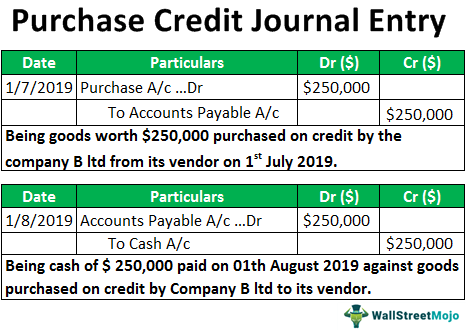

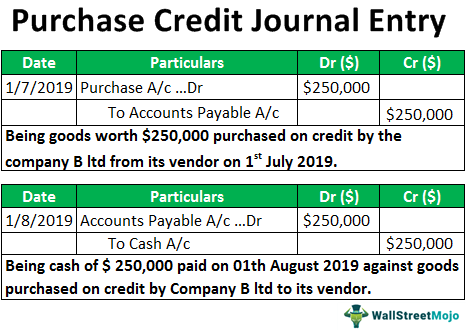

Purchased Goods on Credit In simple terms when an organization or customer purchases the goods from the seller or supplier and agrees to pay the consideration value or. Your credit sales journal entry should debit your Accounts Receivable account which is the amount the. The customer charges a total of 252 on credit 240 12.

This 5000 of the goods sold had an original cost of 3000 in the inventory account. Purchase returns are applicable for credit transactions. Cost of Goods Sold COGS Opening Inventory Purchases Closing Inventory Or Cost of Goods Sold COGS Opening Inventory.

Sold goods on credit is nothing but the sale of goods on a credit basis ie. Verify the beginning inventory balance. In other words the total finished goods that were sold was 600.

The journal entry for Goods sold on credit is -EXPLANATION. The actual amount of beginning inventory owned by the. Everytime an item of inventory is sold the physical transaction is as follows.

Therefore the double entries for this are as follow. This amount owed by the debtor leads to an increase in the accounts receivables of the company and is a current asset. Journal entry for sold goods on credit.

The cost of goods sold entry records the total of all direct. Goods are denoted as.

A Journal Entry In Accounting Is The Learn Accounting Facebook

Buy Goods On Credit From A Supplier Double Entry Bookkeeping

Purchase Credit Journal Entry Definition Step By Step Examples

0 Response to "Sold Goods on Credit Journal Entry"

Post a Comment